Income tax return is a form which is filed with the authority. It reports pay, costs, and other pertinent tax data. Tax forms make it simple for citizens to decide their tax liability, plan their tax payments and solicitation discounts for it’s over payment. Citizens are expected first to decide the kind of ITR forms they need to fill before really presenting the profits. ITR forms are exclusively reliant upon the pay of citizens. In this blog I have discussed where to send ITR in Bangalore?, Types of ITR, benefits, the difference between income tax & income tax return and the latest news on ITR-V.

Benefits of filing Income tax forms online

Following are the merits of Online filing of IT forms on the online:

Speed:

Be it acknowledgement of ITR forms or the guaranteeing the discounts, the interaction has become very smooth and consistent when contrasted with regular paper filing strategy.

Adaptability:

Taxpayers have the influence to file their tax forms at whatever point and any place you feel like according to their comfort.

Precision:

Online filing software permits you to e-file the profits as they have inborn mechanisms.

Security:

Online filing is very more secure when contrasted and paper-based filing as it is carefully designed.

Openness:

The E-filing software application is one of the simplest ways of acquiring data.

Environment cordial:

- Online filing requires just about zero administrative work which is totally not quite the same as paper-based filing. E-filing of tax returns has continuously become out to be necessary for the accompanying associations:

- An association, individual or HUF (Hindu Undivided Family) who wish to go for audited of their accounts under section 44AB.

- An individual who guarantees a tax deduction according to section Income tax Section 90, 90A or section 91.

- All the association or all the AOP or BOI

- A political coalition, on the off chance that their available income outperforms a limited sum, not guaranteeing rejections U/S 13A

- An individual who procures Rs. 5 Lakhs in the previous year needs to file income returns independently and that individual needs to top off IT forms in the form ITR7.

- Occupant and HUF that has resource or monetary interest or with signing expert in any association abroad.

ITR-V

ITR-V is an acronym for Income Tax Return-Verification Form. It is a single page document. You get an ITR-V subsequent to filing IT return online when you don’t involve a digital signature for the same. This form is sent by the IT Department to confirm whether the report you submitted without a digital signature at the hour of e-filing is certifiable or not. Subsequent to getting the Form ITR-V you want to place your marks in the Form utilizing ‘blue ink’ and post it to IT Department CPC, which is situated in Bangalore to finish the documenting system.

Form ITR-V

If the individual who is paying the taxes filed returns online by Tax return filing in Bangalore does it without utilizing the digital signature then the individual necessities to send ITR-V to the CPC (Central Processing Centre) of the Income Tax Department which is situated in Bangalore. In the event that the individual neglects to do as such, the profits are viewed as invalid.

Income Tax Return (ITR-V – Verification is a sort of acknowledgement given for the profits) is a page long report which the taxpayer gets when they decided to e-File returns and don’t utilize a digital signature. The report that verifications the genuineness of taxes is shipped off the taxpayer by the income tax department. Thusly, you want to affirm the authenticity of your e-filing returns report and for this, no digital signature is required.

How to ensure that the documentation is proper?

The PAN (lower case) is the password for your document and this is in addition to the date of birth (DDMMYYYY). Taxpayers need to follow the instructions below.

- A4 size paper must be used.

- The print-out needs to be clear and not in faded form.

- The taxpayers must sign using blue ink.

- Ensure that the taxpayer does not sign on the barcode.

- Please ensure that barcode and the numbers are clear.

- Please do not fold or staple the document.

- Pre-stamped envelopes and no annexures must be attached with ITR-V form

- ITR-V form should reach the CPC in 30 days (formerly it was 120 days) of the filing of returns.

- In order to print the original and revised forms you need to attach two distinct forms.

- After receiving the ITR-V form taxpayer needs to sign on form’s copy.

Digital signature

Assuming the individual paying the taxes consolidate their digital signature (this will cost around some amount) while filing income tax returns on the online by Tax return filling in Bangalore. The process gets finished with this no further customs are required. The individual paying the tax will get to get an acknowledgement from the income tax department and they tell them utilizing an email.

At the point when the individual paying the taxes files the income tax returns online putting a digital signature, then the process is supposed to be deficient. The profits are all things considered should be shipped off the Central Processing Centre (CPC) which is arranged in Bangalore.

Where to send ITR in Bangalore?

After completion send to the postal address: Income Tax department – CPC, Post box No1, Electronic city post office, Bangalore – 560500, Karnataka, India. (Formerly 560100 pin code was used. But due to some complaints emerged, new pincode is given for the tax payers).

The filing can be done by Tax return filing in Bangalore, which is our reputed consultancy in Bangalore.

After How Many Days the Receipt for Acknowledgment can be received?

Ordinarily, the receipt is gotten in something like 3 weeks from the date on which you post your ITR-V form which is to send an acknowledgement to the email id of the taxpayer. On the off chance that the acknowledgement isn’t arrived at in the span of 3 weeks, then, at that point, you really want to send one more copy of your income tax forms to the CPC, income tax department.

What is the Process to Follow in Case you Haven’t Received Any Acknowledgment?

If the taxpayer neglects to get an acknowledgement, they need to login in the official income tax website and this will open up their online account. From that point you can download your form. You will get the acknowledgement once opening up ‘E-filing process status’ which you will get underneath ‘My Account’.

To get the acknowledgement receipt, they are required to add their PAN as well as an extended period of evaluation. You can likewise enter the acknowledgement number of your e-filing on the ‘ITR-V Receipt Status’ tab referenced underneath ‘Services’ menu of the site.

To know the situation with e-filing restores, taxpayers additionally have the influence to ring to the call Centre of the Central Processing Centre.

In the event that you have filed your tax forms after the fulfilment of the tax year, then the income tax department levies penalty of some amount and this is according to section 271F. Assuming that you neglect to file the profits on the due date, under section 139(1), the misfortune that is caused in the ‘benefits and gains of business and professions’ as well as ‘capital gains’ are not conveyed forward to the following year.

The Aadhaar Connection:

The Central Board of Direct Taxes (CBDT) has sent off another system in which an electronic confirmation code in view of Aadhaar is shipped off the individual who pays the tax to validate the record, accordingly this eliminates the need to send copies to CPC which is situated in Bangalore for verification.

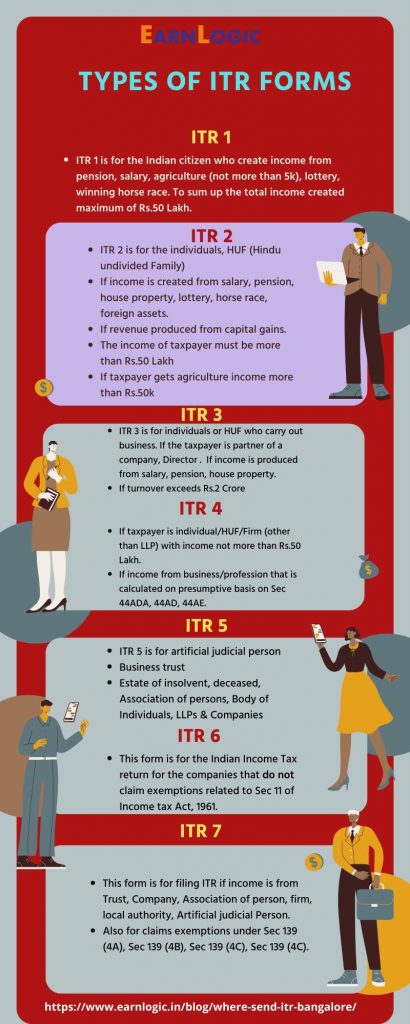

Types of ITR Forms

ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, ITR7.

What is the difference between Income Tax and Income Tax Return?

Income tax

With regards to income tax, it is the sum an individual needs to pay for the cash they procure for the said financial year. The tax liability is determined in light of the pay, tax slab the individual falls under and different factors like rebate, savings, investment, and so on.

Income tax return

Income tax return, then again, is only the annual record of your income, tax liability, tax paid, and investments for the said financial year. This record is grouped and submitted to separate experts in the required format known as income tax return file.

Accordingly, annual tax is the sum that you (the citizens) pay and the income tax return is the yearly record of the same. The ITR can be done by Tax return filing in Bangalore.

Significance if Income tax filing

Individuals who are old enough 60 years and below earning Rs. 2.5 Lakhs are at risk to pay tax in India. Most salaried people feel that their manager deducts tax at source and it is finished. Notwithstanding, it is vital to take note of that ITR and personal assessment are two separate things.

Whether you have any assessment liabilities, it is required to file your annual income returns by Tax return filing in Bangalore. The significance of doing so is as per the following –

It assists with the loan processing

It assists with the VISA process

Most banks won’t give credit cards until the candidate documents his/her profits

It assists construct a record with the Income Tax Department of India.

Latest news on ITR-V

The Income Tax division has diminished as far as possible for e-verification or hard copy submission of the ITR-V, post-filing taxpayer returns, from 120 days to 30 days, starting August 1.

The department gave notification on July 29 reporting the change of the timetable.

E-verification of an ITR finishes the return filing process, and on the off chance that it isn’t finished inside the specified time, an ITR is treated as invalid.

” e-transmission of return information on or past date of this notice for e-check will have accommodation of ITR-V will be 30 days from the date of return information sent ” the notification said.

As of not long ago, the period to e-verification the ITR or send the ITR-V through the post in the wake of documenting an Income Tax Return (ITR) was 120 days from the date of the ITR upload.

The notice explained that if that the e-confirmation of the ITR or printed copy ITR-V is sent through post beyond the time limit of 30 days, the return will be treated as late or beyond due date.

” The date of dispatch of ITR-V by means of speed post is for 30 days. This is from the date of sending Income-return date electronically,” it said.

Who we are?

We Earnlogic are serving people over decade. We have thus covered important points and recent news on ITR. For further clarifications please click here.

You may also share the information above in this blog by scanning this QR-code below.