Limited Liability Partnership

An LLP registration is not compulsory but can provide added benefits if done. A very prevalent way to set up a business is LLP. Here two or more people co-ordinate the business. People usually prefer LLP over all other types as it provides a good number of benefits. LLP is flexible enough to provide liberty to its partners to invest as they wish. In an LLP all the partners or owners own equal rights.

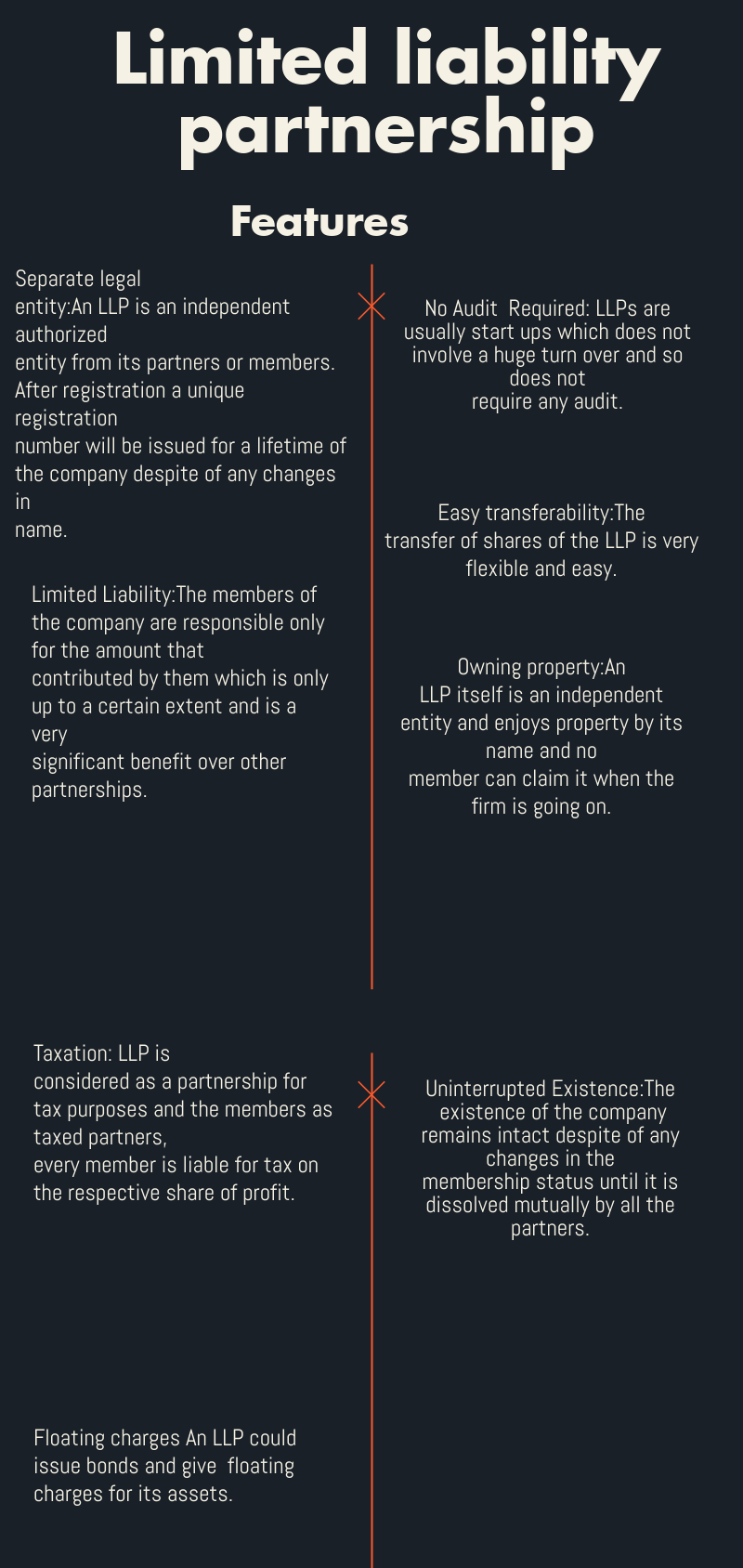

The general features of LLP are:

Separate legal entity:

An LLP is an independent authorized entity from its partners or members. After registration a unique registration number will be issued for a lifetime of the company despite of any changes in name. An LLP is capable of entering into contracts and holding property. The existence of LLP remains intact despite of any changes in membership.

Limited Liability:

The members of the company are responsible only for the amount that contributed by them which is only up to a certain extent and is a very significant benefit over other partnerships.

The special cases of personal liability includes the following :

- Negligence

If any third party suffers a loss due to the negligence of a member then the member can be subjected to legal action by the third party.

- Fraudulent Trading

The provisions of fraudulent or illegitimate trading apply similar as the other limited firms if the LLP members (a) continue trading despite of being aware of the fact that it has no forecast just to avoid bankruptcy (b) continue trading with an intention of deception ,the members liable personally.

- Personal Guarantees

A guaranty from the members is required if anyone wants to contribute money to the LLP. Members of the company should validate the agreement of other member for the guarantee in case of reimbursement.

Taxation:

LLP is considered as a partnership for tax purposes and the members as taxed partners, every member is liable for tax on the respective share of profit.

Organisational flexibility:

An LLP is considered to have organisational flexibility of partnership which includes the below matters:

- Profits and losses.

- Drawings

- Ownership of property.

- Admission or inclusion of new members.

- Retirement/exclusion of members.

- Reimbursement and insurance.

- Meetings/decision making.

- Restrictive bonds.

Designated members:

An LLP should contain at least 2 members. These members have certain roles and responsibilities such as

- Auditor appointment.

- Preparing and approval of annual accounts of the company and delivery to Companies House.

- Notifying Companies House in case changes in the LLP’ s name, membership or address of the registered office.

Accounting and filing requirements:

LLPs are suppose to give financial information. Below mentioned are the documents that should be must filed at the Companies

- Annual return document.

- Annual accounts document.

- Documents of the changes made in the company’s name , membership and registered office address.

- Document of any charge created by the LLP.

Floating charges

An LLP could issue bonds and give floating charges for its assets.

Advantages of LLP:

Separate legal entity

An LLP is an independent authorized entity from its partners or members. After registration a unique registration number will be issued for a lifetime of the company despite of any changes in name.

Uninterrupted Existence

The existence of the company remains intact despite of any changes in the membership status until it is dissolved mutually by all the partners.

No Audit Required

LLPs are usually start ups which does not involve a huge turn over and so does not require any audit.

Limited Liability:

As there are multiple partners or members involved the risks, duties and investments are equally done by them so an individual person is not liable for the loss of any company.

Easy transferability:

The transfer of shares of the LLP is very flexible and easy.

Owning property:

An LLP itself is an independent entity and enjoys property by its name and no member can claim it when the firm is going on.

LLP registration:

Application of DSC & DPIN :

As all the document must be submitted online the partners require a DSC and DPIN . If the partners don’t have a DSC and DPIN, then they need to get DSC and DPIN for all the designated partners of the firm which takes 5 to 7 days of time.

Name approval :

A maximum of 6 unique names have to given to the MCA. Based on the availability and naming guidelines the name will be approved in a matter of 5 to 7 days. The names should be relevant to the business.

MOA & AOA submission :

After the approval of name Articles of Association and Memorandum of association should be filed and drafted with the statement of subscription.

Get registration certificate :

Registration documents and an application for incorporation can be submitted to the MCA and the approval takes 5 to 7 days. After registration Incorporation certificate and a CIN number will be issued as a proof of incorporation or registration.

PAN, TAN and Bank account application :

The partners should apply for documents like PAN and TAN which could be received in 7 days after which the incorporation certificate, AOA, MOA and PAN can be submitted for opening a bank account.

The following are the documents required for LLP registration:

For Indian Nationals:

- Copy of PAN card of all proposed partners.

- Copy of Address proof must be produced. The name mentioned in the PAN card should match with that of in the proof. Ration card/Voter identity card/ Aadhaar card/Driving license/ telephone bill or Electricity bill can be provided as address proof.

- Residential proofs such as Bank statement/ Electricity bill/ telephone bill should be submitted.

For foreign Nationals:

- Copy of passport is a mandatory requirement and it has to be properly notarized.

- The name mentioned in the passport should match with that of in the address proof.

- Residence card/ driving license or bank statement can be submitted as address proof.

- Residential proofs such as Bank statement/ Electricity bill/ telephone bill should be submitted.

Documents required by the office registered:

- Copy of the rental agreement is required in case of a rented office has to be produced.

- A copy of ownership document if it is owned by the members.

- Document of NOC from landlord for rented one.

- Utility bills such as electricity bill/gas bill/water bill/telephone bill should be submitted as a proof of evidence.

Earnlogic, one of the leading company registration in Bangalore can help you in your LLP registration. For more information visit earnlogic website.