A private limited company registration is not compulsory but can provides good number of benefits if registered.Private limited company is generally a company that is privately held for small businesses by two people or more. The liability of the members are limited to the amount of shares held by them respectively. There can be a maximum of two hundred shareholders and number of directors can vary between two to fifteen.

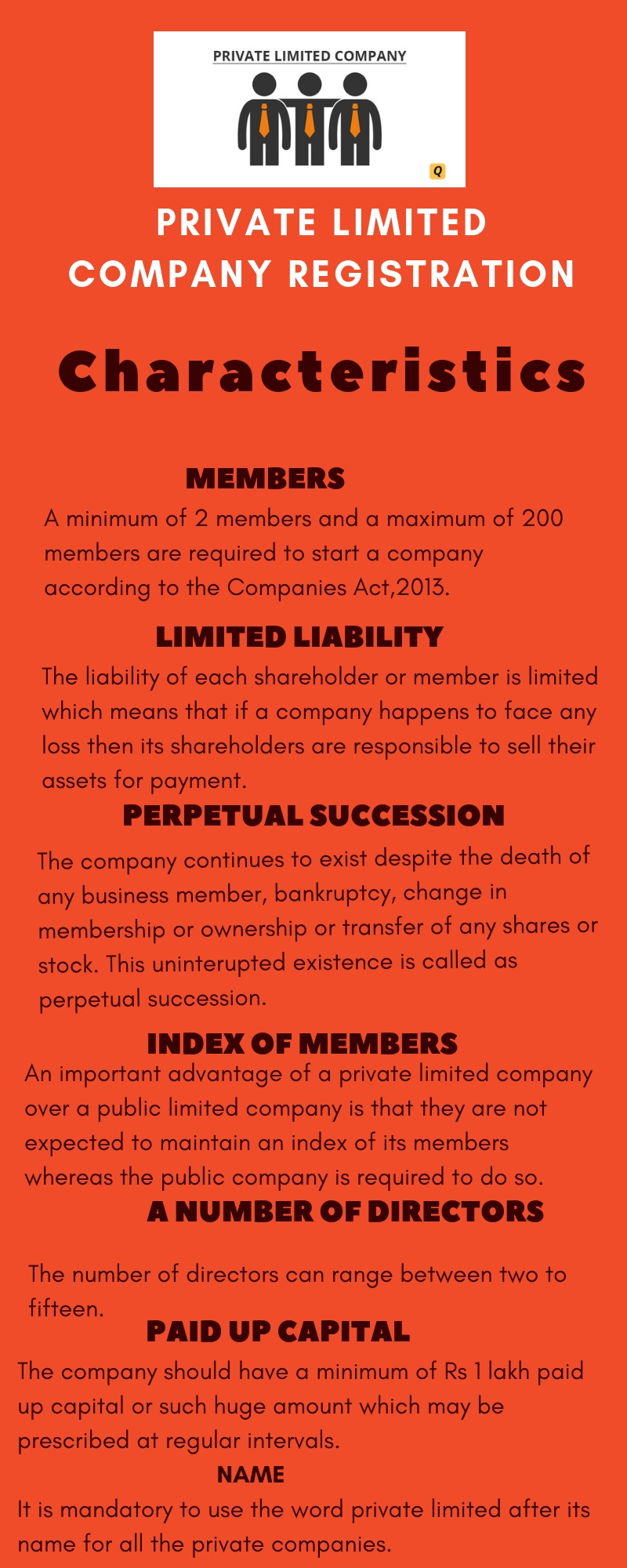

The following are the basic characteristics of a Private Limited Company:

1)Members

A minimum of 2 members and a maximum of 200 members are required to start a company according to the Companies Act,2013.

2)Limited Liability

The liability of each shareholder or member is limited which means that if a company happens to face any loss then its shareholders are responsible to sell their assets for payment.

3)Perpetual succession

The company continues to exist despite the death of any business member, bankruptcy, change in membership or ownership or transfer of any shares or stock. This uninterupted existence is called as perpetual succession.

4) Index of members

A private limited company is not expected to maintain any index of its members.

5)A number of directors

The number of directors can range between two to fifteen.

6)Paid up capital

The company should have a minimum of Rs 1 lakh paid up capital or such huge amount which may be prescribed at regular intervals.

7)Prospectus

Prospectus is a comprehensive statement of the company which is issued by itself for its public. So, you don’t provide any prospectus in case of a private limited company because the public is not included for any of the company’s shares.

8)Minimum subscription

90% of the shares issued is the amount received by the company. If the company fails to receive the amount then they cannot proceed business further and in that case, shares of the private limited company can be allotted to the public.

9)Name

For registering a private limited company, it is mandatory to use the word private limited after its company name.

Requirements of Private limited Company Registration:

The private limited company registration requirements are as follows:

1)Members

Minimum two member of shareholders and maximum of 200 members according to the Companies Act,2013 before your company registration process.

2)Directors

The number of directors should be 2 for registering a private limited company. Every director should have DIN i.e. director identification number and one should be a resident of India.

3) Name

The company’s name has three parts such as the activity, the name and private limited company. For registering a private limited company it is mandatory to include the word private limited company after their company name. Every company must send up to 5-6 unique and expressive names for approval. The company name confirmation should not match with any of the existing company.

4) Registered office address

During private limited company registration, the owner should submit the present company address of until the company is not registered. After the company registration its permanent address of the registered office should be adapted with the registrar of the company. This is the place where companies important events are held and documents are maintained.

5) Obtaining digital signature certificate

The private limited company directors and their documents are submitted electronically for getting their digital signature certificate which is helps to confirm the directors verification. A digital signature is mandatory for all directors for signing on every document.

6) Professional certification

The professionals like chartered accountant, cost accountant, company secretaries should have a certification at the time of registration.

The documents required for private limited company registration:

- A copy of PAN card is mandatory during the company registration process. The name written in the PAN card will be used as it is for everything that is related to the company.

- The address proof copy should be compulsory for registering your private limited company. The PAN Card should have your name and it should match with that of in the PAN card.

- Utility bills such as electricity bill/telephone bill/water bill can be submitted as a proof of evidence on your registration.

- Every shareholders should be submitted their address and identity proofs and it should be valid proofs. If one of the shareholder as a corporate entity, the registration document should be included.

- Your complete proofs should be submitted in the company registration office address within 30 days of your registration or formation process all the proofs should be submitted.

- The rental agreement copy should be submitted by the authorized person. The landlord NOC is need to be submitted if they having an rented office or an ownership document can be produced.

Private limited company benefits are listed below:

OWNERSHIP

In a private limited company, the shares can be transferred or sold to some people with the decision of owner’s choice. The company’s shares are owned by management, founders or a group of private investors. Shares of a private company are not sold or traded in open market. Hence, some shareholders have confusion and complexity.

LEGAL FORMALITIES

A private limited company generally does not have many legal formalities when compared to that of a public company.

DISCLOSING INFORMATION

A private limited company is not mandatory to close their financial reports to the public unlike the public company.

MANAGEMENT AND DECISION MAKING

The management and decision making is easy and less complex due to less number of shareholders.

FOCUS OF MANAGEMENT

The private limited company managers are more flexible in short and long term business decisions on registration process.

STOCK MARKET PRESSURE

Private limited companies are not force any by the stock market and they don’t consider their shareholder expectations and interference.

LONG TERM PLANNING

Private limited company needs long-term gaining as there is no need to improve their value of stock.

MINIMUM SHARE CAPITAL

The share capital for a private limited company previously was Rs 1 lakh .But there is no such criteria now which in turn eliminates the pressure of fund requirements.

CONFIDENTIAL

It has legal settlements ,executive compensation and other major details are more secure in the incorporation of private company.

For more information visit https://www.earnlogic.in