All Indian goods and services are subject to the Goods and Services Tax (GST). Every vendor with a turnover of Rs. 50 lakh or more is required to register for the GST. In some instances, failure to register the business could result in substantial fines, punishment, or even incarceration. Assuming that one’s business falls under this class it is fundamental to know about the course of GST registration in Chennai.

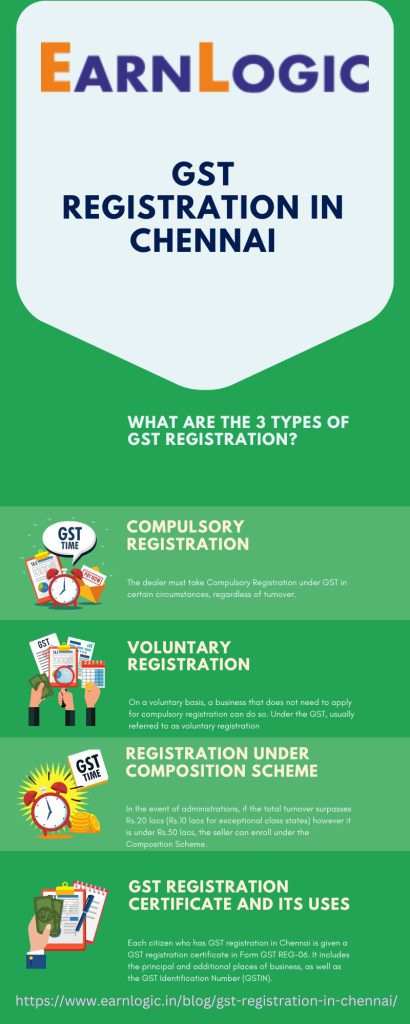

What are the 3 types of GST registration?

GST registration in Chennai implies applying for unique GST Number or GSTIN for example GST Distinguishing proof Number on the GST portal.

The citizen requires GSTIN to gather and pay GST on the outward supplies for example deals and guarantee GST input tax reduction on the internal supplies for example buys. The nature of the business determines the types of GST registration which can get GST registration in Chennai.

Types

GST with GST registration in Chennai, can be of following types.

Compulsory registration

The dealer must take Compulsory Registration under GST in certain circumstances, regardless of turnover.

For eg: interstate sales of taxable goods, operators of online stores, sellers of online stores, etc. This type of GST can get GST registration in Chennai at a considerable rate.

Voluntary registration

On a voluntary basis, a business that does not need to apply for compulsory registration can do so. Under the GST, usually referred to as voluntary registration. This type of GST can get GST registration in Chennai at an affordable cost.

Registration under composition scheme

The dealer is eligible to register under the Composition Scheme if the total turnover for goods exceeds the prescribed threshold of Rs.40 lacs (Rs.20 lacs for special category states) or Rs.20 lacs (Rs.10 lacs for special category states) but falls below Rs.1.5 crore (Rs.75 crore for special category states).

In the event of administrations, if the total turnover surpasses Rs.20 lacs (Rs.10 lacs for exceptional class states) however it is under Rs.50 lacs, the seller can enroll under the Composition Scheme.

The taxpayer should pay GST at a fixed rate based on turnover under this plan, and compliance is lower than with normal registration.

This type of GST can get GST registration in Chennai with a team of experts.

No registration

The following individuals do not need to have GST registration in Chennai:

- The company whose total revenue for the previous year does not exceed Rs. 40 lakhs for goods (Rs. 20 lakhs for states in special category) or Rs. 20 lakhs for services (Rs. 10 lakhs for states in special category).

- The company that is exempt from mandatory registration requirements.

- Individuals selling goods or services that are not covered by GST or are exempt from it.

- Agriculturists for the purpose of supplying crops that are grown on land.

How much does a CA charge for GST registration?

GST registrations made online through the government portal are free of charge for the government. As previously stated, you will receive an Application Reference Number (ARN) via your registered phone number and mail once the relevant documents have been uploaded. They must be placed in the appropriate text boxes on the pages you will be viewing.

How long is GST certificate valid?

If the application for GST registration in Chennai is submitted within thirty days of the person becoming liable to GST registration.

The certificate of GST registration in Chennai is valid from that date. On the off chance that not, then, at that point, legitimacy starts from the date of allowing the testament under the CGST Rules 9(1), 9(3) and 9(5).

The officer must send the signed registration certificate within three working days of the period specified under the same sub-rule if an application falls under cases of delay by the officer under CGST Rule 9(5).

If distributed to all regular taxpayers, the certificate has no expiration date. The GST which has GST registration in Chennai is valid as long as it has not been surrendered or cancelled.

For an easygoing available individual, since the GST registration in Chennai stays legitimate for a limit of ninety days, the enlistment certificate turns invalid after that. However, the taxpayer has the option of renewing or extending the validity before the expiration date.

How to get GST registration certificate? – A glance

By going to www.gst.gov.in in a web browser, any person who is eligible can apply for a GST registration in Chennai on the GST portal. The registration must be approved after the proper officer has checked the application properly.

If the application is received within thirty days of the date liability for GST registration in Chennai arises, the registration will take effect on that date.

However, the GST registration in Chennai is valid from the date of registration grant if submission was delayed.

It’s possible that bank account information will be provided in the future. They must never submit before two dates, namely 45 days from the date of registration grant or the due date for filing the form GSTR-3B return.

You may approach Earnlogic to have GST registration in Chennai at an affordable cost.

GST registration certificate and its uses

Each citizen who has GST registration in Chennai is given a GST registration certificate in Form GST REG-06. It includes the principal and additional places of business, as well as the GST Identification Number (GSTIN).

The government does not issue a physical registration certificate; the certificate can only be downloaded from the GST Portal.

The kind of citizens incorporates customary, TDS and TCS candidates under GST, the individuals who are at risk to acquire exceptional Personality Number under Section 25(9) of the CGST Act, non-occupants including those that are giving OIDAR administrations, and the citizens who moved from the pre-GST regulations.

The certificate of GST registration in Chennai is marked or confirmed utilizing EVC by the checking charge official prior to sending it to the citizen.

This certificate must be displayed at the taxpayer’s primary place of business and any other places of business listed on Form GST REG-06.

It is stated in CGST Rule 18(1), and any violation can result in a fine of up to some amount.

The GST portal lets taxpayers or users download a new GST registration certificate with the updated information whenever there is a change to the information on the GST registration in Chennai.

Conclusion

In India, a valid document to demonstrate registration under the GST law is a GST registration certificate. GST registration in Chennai is required for any Indian business whose turnover exceeds the threshold for GST registration. Additionally, certain businesses, such as casual taxable persons, non-resident taxable persons, and others, are required to GST registration in Chennai. We Earnlogic offer GST registration in Chennai at an affordable cost.